What Is Customer Lifetime Value (LTV) and How to Calculate It? The Ultimate Guide

By Samuel Kellett

01/29/2024

The importance of customer lifetime value (also called CLV, CLTV, LCV, or LTV marketing) has been understated for a long time. And more often than not, it's the most important metric that companies ignore.

Marketers have been writing about how important knowing CLV and LTV is for years, but it’s still being ignored or underutilized: only 42% of companies are actually able to accurately measure CLV. This is despite the fact that 89% agree that CLV and a great customer experience are crucial for driving brand loyalty.

- CLV is simply defined as the value a customer represents to a company over a period of time.

- CLV can be calculated by multiplying the average annual profit of a customer by the average duration of customer retention.

- Customer lifetime value is important because it informs how much your company can/should spend on customer acquisition.

What Is Customer Lifetime Value (LTV)?

Customer Lifetime Value (CLV or CLTV) is a pivotal metric, offering insights into the anticipated total revenue a business can derive from a single customer account over the course of their entire relationship. This metric takes into account the revenue generated by a customer and aligns it with the anticipated duration of the business relationship.You can calculate a simple customer lifetime value model for your company with this formula:

There are other methods of calculating customer lifetime value that get much deeper and can focus on the average customer or an individual customer. To illustrate this, this article is going to cover the importance of CLV, a customer lifetime value formula you can use to find it, and the actionable ways you can use it to measure customer lifetime and improve your business.

What Is the Difference between CLV and LTV?

CLV and LTV are both used as shorthand for customer lifetime value, and they essentially share the same meaning. There’s no industry-established difference between the terms and marketers often use them interchangeably.

Some people differentiate between CLV and LTV in terms of specificity, with CLV identifying the value of an individual customer over their entire relationship with a brand and LTV referring to the average customer lifetime value of all existing customers.

But without company-specific factors for any one business’ calculations, this small degree of differentiation essentially produces the same metric, which is why the terms are understood to be identical.

Why Is Customer Lifetime Value Important?

Customer lifetime value calculations will get you one answer, but the knowledge you gain can be applied in a multitude of ways:

It Informs How Much You Should Spend on Customer Acquisition

Your customer acquisition costs (CAC) may very well equal more than you make from a customer's first purchase. But that doesn't take into account the average customer lifespan — are you still making money from that customer in the long run?

Figuring out the average lifetime value of a customer to your company will give you the answer.

It Allows You To Segment Your Customers Based on Value

"Using CLV, you can better understand the different personas among your customers — the first step to effective targeting or personalization."

Daniar Rusnak | Bloomreach Academy, Senior Trainer

Calculating your CLV allows you to narrow your marketing focus for more effective campaigns. When you know how valuable a customer is in the long term, you can create better interactions with your high-value customers and foster more meaningful engagement.

You can send a special offer or gift to your “VIP” customers, or focus on acquiring new customers with similar backgrounds. You can also nurture less valuable customers and start upselling to build a high customer lifetime value. Viewing your audience through customer segments allows for a personalized experience — which is key to keep your customer retention rates high.

Focusing on CLV Is Key for Long-Term Company-Wide Growth

It’s a competitive market for ecommerce companies, and price isn’t the only determining factor in a customer’s decisions.

CLV is a customer-centric metric, and one that depends on giving your audience a great customer experience. It's a powerful base metric to build upon to retain customers, increase revenue from less valuable customers, and improve the customer experience overall.

The Process of Finding Your CLV Is Valuable

"The advantage of determining customer lifetime value is not just the final number itself, but also the thinking and calculation behind the metric."

Lukas Sitar | Inbound Marketing Specialist

Determining your business' CLV or LTV provides more than one statistic. The process of finding your customer lifetime value will make you think — not just about the sale, but about the full customer journey: when, where, why, for how much, and how often do your customers make a purchase?

Answering these questions will bring valuable insights, lay out clear ways to strengthen your customer journeys, and help you spot issues in your customer engagement plan that you may not have noticed before.

How to Calculate Customer Lifetime Value? (With Examples)

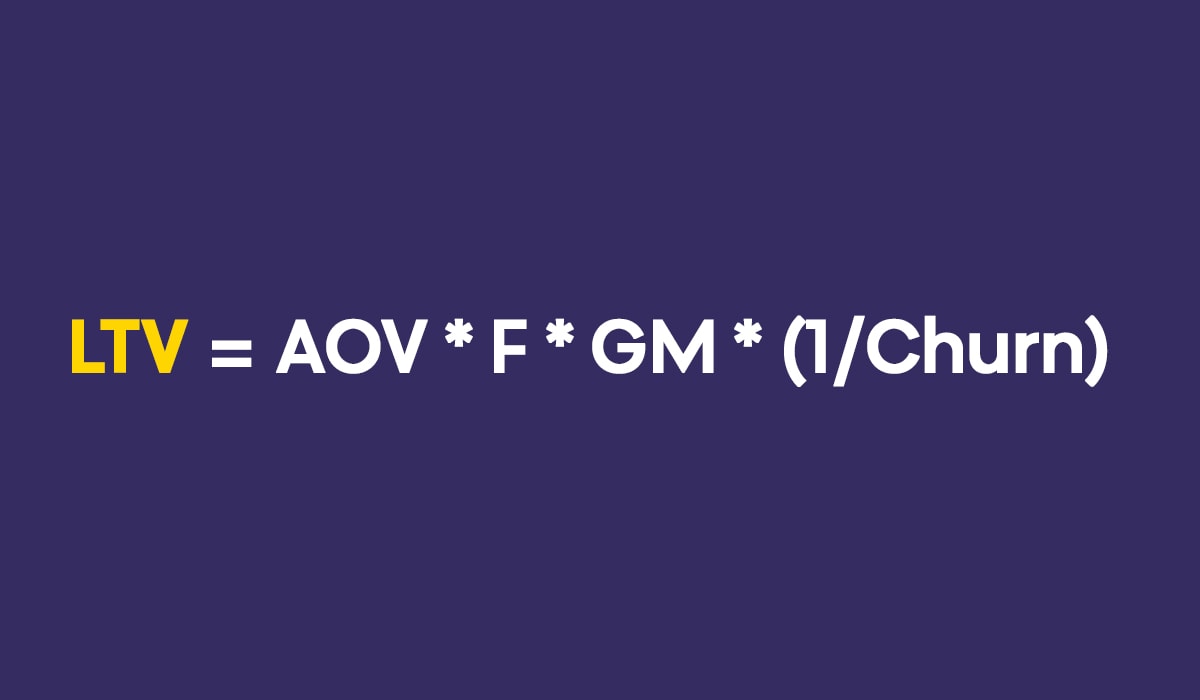

There are four KPIs that determine your LTV: average order value (AOV), purchase frequency (F), gross margin (GM) and churn rate (CR).

With all these metrics, you can use this formula to calculate customer lifetime value:

With this customer lifetime value model, all you need to do is break down the equation to identify each factor and plug them all in to the formula.

It’s important to look at each of these KPIs individually and determine their individual values before plugging them into the equation. This will help determine which one needs the most work in terms of profit maximization.

How to Calculate Your Average Order Value (AOV)

First, we need to calculate your AOV using this equation:

AOV = Total Sales Revenue / Total Number of Orders

Let's walk through an example computation of Company A's average order value:

AVERAGE ORDER VALUE ANALYSIS: COMPANY A

Total Sales Revenue (annual): $1,000,000

Total Number of Orders (annual): 40,000

1,000,000 / 40,000 = 25

Company A has an average order value of $25

How to Calculate Your Purchase Frequency (F)

Next, you need to calculate your purchase frequency, or the number of times a customer completes a purchase in a given period of time:

F = Total Number of Orders / Total Number of Unique Customers

Let's continue our example to find Company A's purchase frequency:

PURCHASE FREQUENCY ANALYSIS: COMPANY A

Total Number of Orders (annual): 40,000

Total Number of Unique Customers (annual): 15,000

40,000 / 15,000 = 2.67

Company A has a purchase frequency of 2.67

How to Calculate Your Gross Margin (GM)

Now you need your gross margin — a business’ profit percentage after subtracting all direct costs of producing or purchasing the goods or services it sells.

GM = Total Sales Revenue – Cost of Goods Sold (COGS) / Total Sales Revenue

To calculate your gross margin, you need to start by calculating the cost of goods sold (COGS) using this equation:

COGS = beginning inventory (inventory left from last year) + additional purchases during period cost – ending inventory (inventory left at the end of the year)

Here's a walkthrough of these calculations using our Company A example:

GROSS MARGIN ANALYSIS: COMPANY A

Beginning Inventory: $180,000

Additional Purchases During Period: $450,000

Ending Inventory: $160,000

180,000 + 450,000 – 160,000 = 470,000

Company A has a Cost of Goods Sold of $470,000

Total Sales Revenue: $800,000

COGS: $470,000

800,000 – 470,000 / 800,000 = 0.41

Company A has a gross margin of 41%

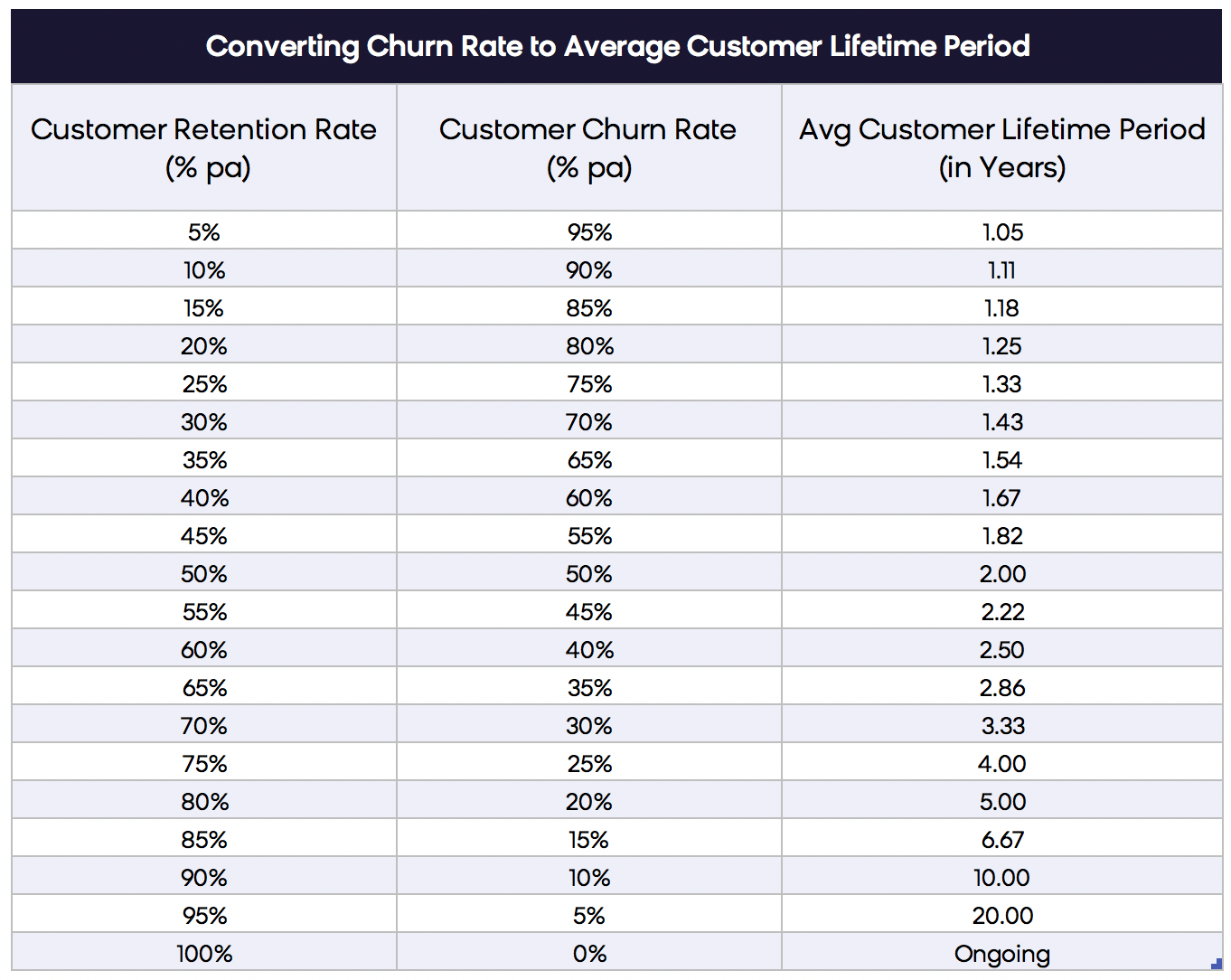

How to Calculate Customer Lifetime Period (1/Churn)

Now it's time to identify your customer lifetime period. To do so, you first need to find your churn rate, or the number of customers who stop doing business with a company during a given period.

Churn Rate = (# of Customers at End of Time Period – # of Customers at Beginning of Time Period) / # of Customers at Beginning of Time Period

Once you calculate your churn rate percentage, you can determine your customer lifetime period.

You can plug your rate into the equation below or consult our corresponding chart to find your average customer lifetime period:

Customer Lifetime Period = 1/Churn Rate

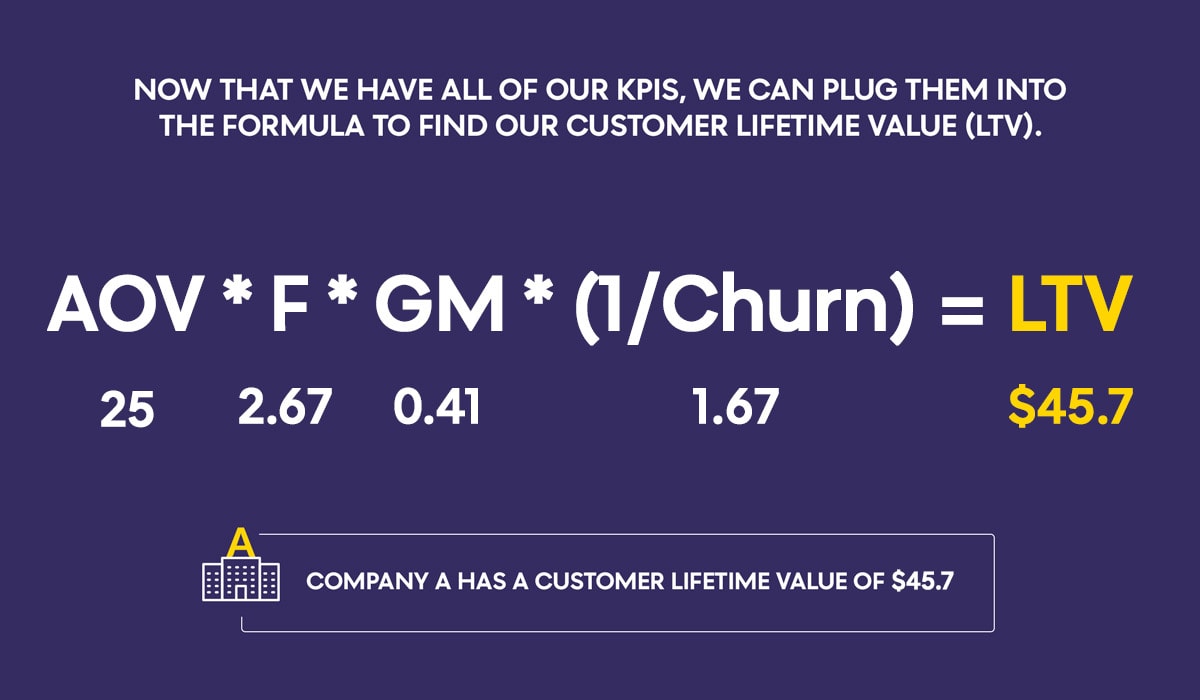

Plugging All Your KPIs Into the Customer Lifetime Value Model

Now that we have all the factors needed, we can plug them all into the customer lifetime value formula. Here's how the formula gets solved for our Company A example:

CUSTOMER LIFETIME VALUE ANALYSIS: COMPANY A

Average Order Value: $25

Average Purchase Frequency: 2.67

Gross Margin: 41%

Churn Rate: 60% -> Customer Lifetime Period: 1,67

25 (AOV) * 2.67 (F) * 0.41 (GM) * (1/0.6) = $45.7

Customer Lifetime Value is $45.7 (per customer)

How to Increase Your Customer Lifetime Value

With our KPIs ready, it’s time to work on our customer value maximization. But which of your KPIs are strong, and which ones need improvement? What is a good profit margin? What is a good purchase frequency?

Compare your KPIs with industry benchmarks to determine which KPI needs the most improvement. It's important to take your industry into account because a good retail profit margin wouldn’t necessarily be a good food services profit margin.

Find current averages for your specific industry, then get to work on reaching — and surpassing — the standard metrics. Which one could improve customer value the most? Remember to focus on your weakest KPI first in order to maximize profit.

How To Improve Your Average Order Value (AOV)

Having trouble getting your customers to increase their spending? Try these campaigns, which focus on providing incentives to increase AOV.

- Add personalized product recommendations to your site. The recommended products should be based on the ideal price point for each individual customer, thereby maximizing revenue.

- Send personalized newsletter campaigns to customers with dynamic product recommendations optimized for price.

- Set up triggered product recommendations for customers based on what they’ve added to their shopping cart, directly on your website.

- Send an abandoned cart email campaign with product recommendations based on what they’ve added to their shopping cart.

- Create product bundles that offer a discount for making a larger purchase. Bundle products that can be used together and recommend the bundle directly on the site, or through email, based off the user’s browsing and shopping cart history.

- Create a customer loyalty program incentivizing spending by adding loyalty points that customers can use for discounts and freebies.

How To Improve Your Purchase Frequency (F)

Maybe your customers spend a lot and you’re making a great margin, but they just don’t order very often. Try a few of these campaigns to maximize profit by nurturing long-term customer relationships.

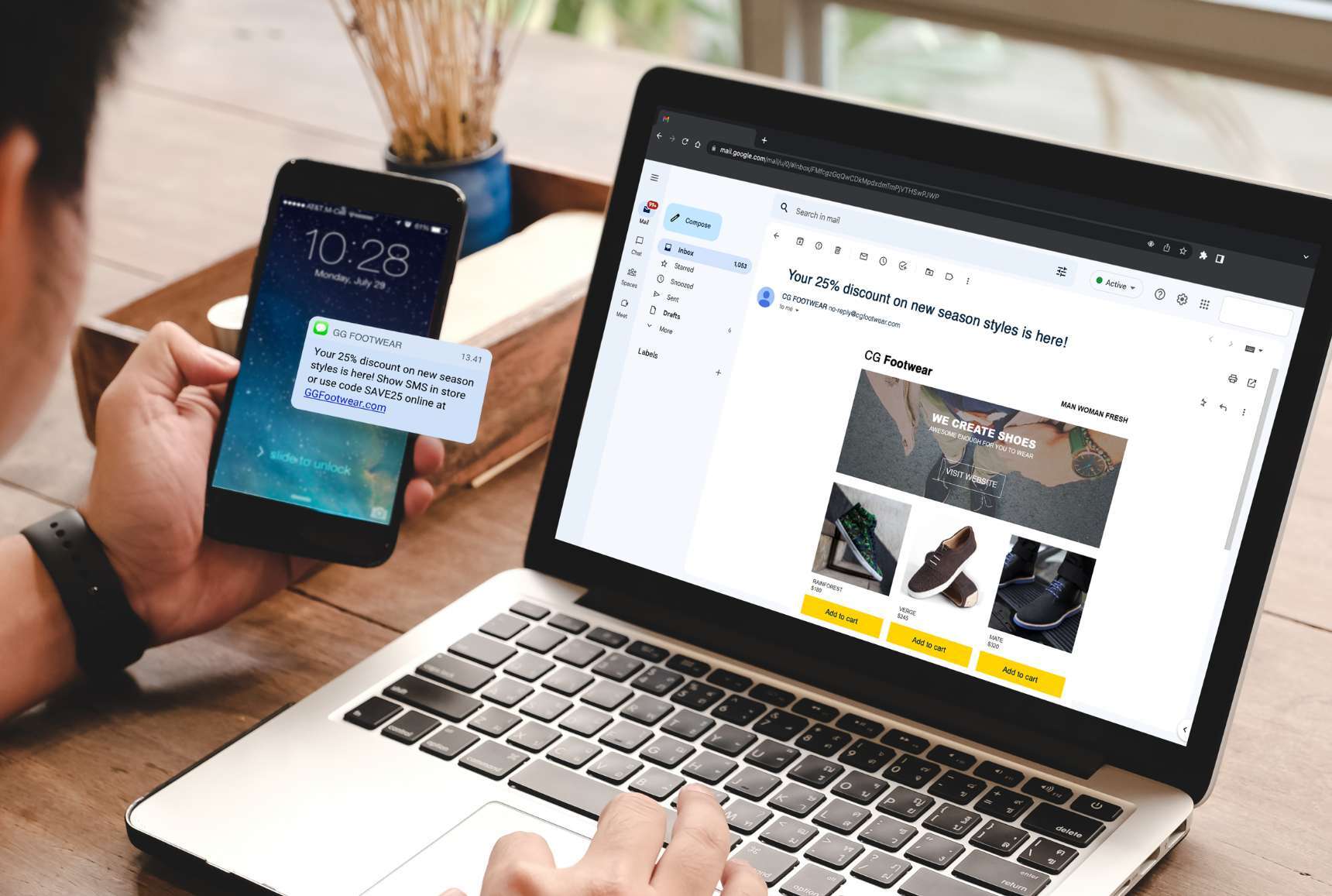

- Communicate dynamically and send emails at the ideal time for each customer — which you can effortlessly achieve with a truly unified single customer view (SCV).

- Test and analyze your communications to figure out if you’re communicating through the right channels. Does this particular customer respond better to email or SMS? Make sure target customers receive your message through their preferred channel.

- Segment your customers by their customer lifecycle stage, then reengage with existing customers who haven’t purchased recently and are in danger of churning.

- Use push notifications and banners to highlight time-sensitive deals based off a customer's browsing history.

- Use banners that trigger when a customer enters and exits the site to recommend personalized products or sales.

How To Improve Your Gross Margin (GM)

It doesn’t matter how valuable your orders are or how frequently they happen if your gross margin doesn’t allow for a profit from the sales. Here are some ideas for profit improvement through increasing the average revenue you make on the sale.

- Use an inventory manager to make better estimates for what you’ll need to resupply your stock for the next year.

- Sell higher margin products. This is an easy way to maximize profit margins, and you can adjust your recommendation models to exclude products that are hurting your margins.

- Use a price optimizer to automatically find the ideal selling price for each of your products based on where they are in the product lifecycle. This will keep you informed of any products with more room for profit maximization.

- Strive to sell leftover products from the previous year to reduce your cost of goods sold.

How To Improve Your Churn Rate (Customer Lifetime Period)

Churn is a very complex metric, and there are many factors that combine to cause a customer to churn from your business. To decrease churn, you need to mainly focus on customer loyalty. Create incredible shopping experiences and your customers will stay with you.

- Set up reengagement campaigns that offer incentives and value for repeat customers.

- Create personalized email campaigns that utilize historical data to speak directly to customers' wants and needs.

- Build a customer loyalty program encouraging spending with points and perks that loyal customers can use for discounts and freebies.

- Provide more ways for customers to engage with your brand by employing an omnichannel commerce strategy, offering seamless communication across channels and elevating customer experience.

How To Use Customer Lifetime Value and Increase Profitability

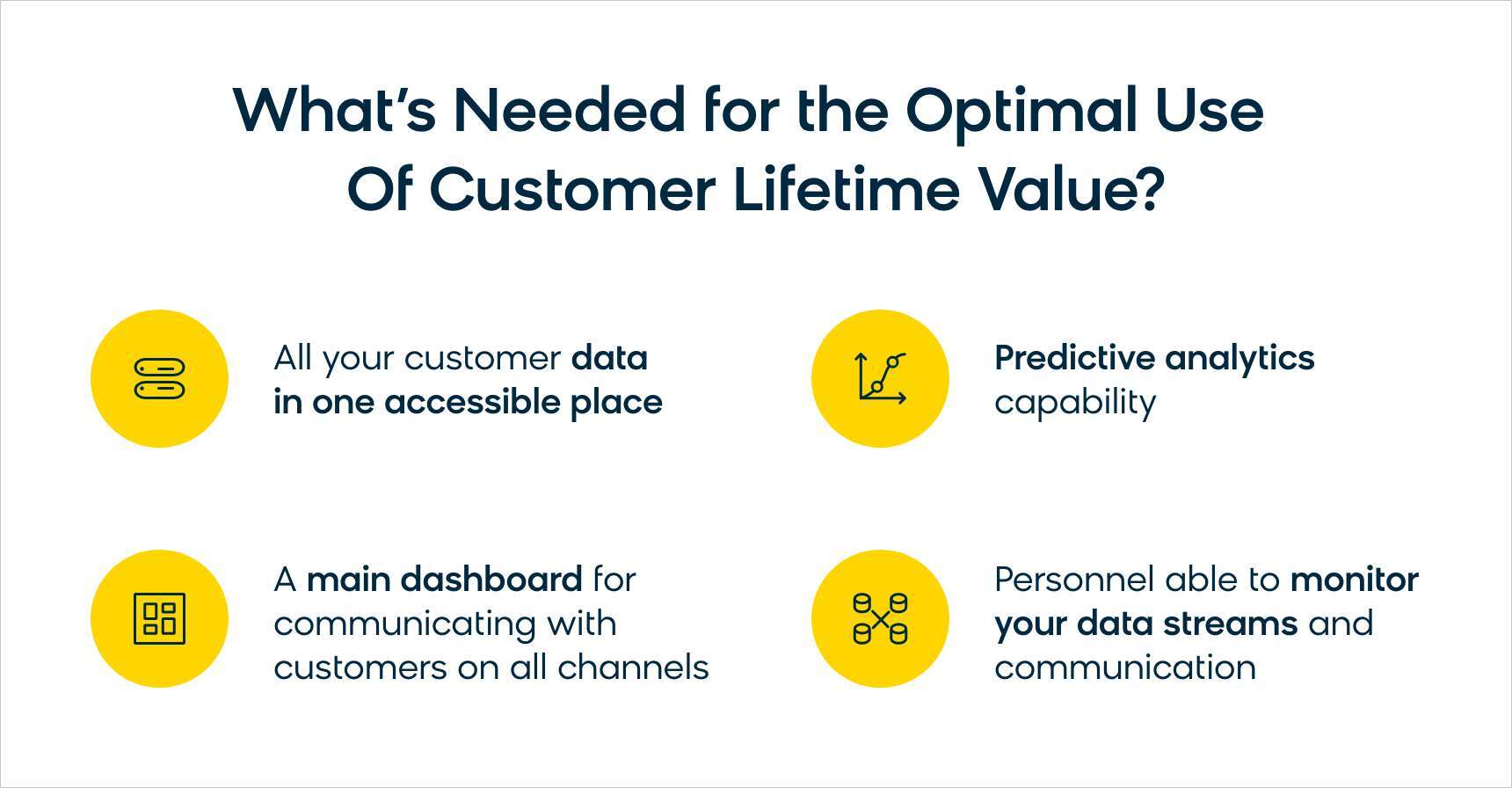

In order to get the most out of your CLV, there are some fundamental capabilities your business must have in your martech stack:

- Access to all your customer data in one place

- A unifying dashboard for communicating with customers on all channels

- Predictive analytics capabilities

- The ability to monitor your data streams and communication channels

Thankfully, marketing technology has evolved to meet all these needs and help businesses optimize their customer relationships. And with the rapid rise of artificial intelligence, your marketing team can easily organize, manage, and activate all your data.

Harness AI To Streamline Your CLV Strategy

AI gives you the ability to handle complex data analysis, intelligent marketing automation, and generate content based on a customer’s past interactions with your brand — all without burdening your marketing team with a massive amount of data to comb through and rules to create for certain customer segments.

AI tools are quickly becoming an essential component of a successful ecommerce strategy, and adopting this revolutionary tech gives you all the capabilities necessary to calculate CLV and reach its full potential.

Read This Next: What Is Generative AI? Everything You Need To Know

Once all your fundamental features are in place, there are numerous actionable uses for your customer lifetime value formula. Using CLV effectively can improve customer acquisition and customer retention, prevent churn, help you plan your marketing budget, measure the performance of your ads in more detail, and much more.

Here are a few of our favorite ways to use CLV:

Acquire High-value Customers

Once you’ve performed a CLV analysis on all your current customers, you’ll know how much you should spend on acquisition. You’ll also know which acquisition channels produce the highest-value customers, and can repeat the strategies you used to find them.

Secure Future VIPs

With a solid data profile of what characteristics your VIPs have, you can use predictive analytics to get a strong idea of which new customers will likely be future VIPs, and focus on these customers with personalized messaging and offers. You can also make use of a look-alike model, as was mentioned in the first section, to target similar profiles.

Practice Value-tier Segmentation

As we touched on in the beginning of this blog, CLV makes it possible to identify which customers are VIPs and which are lower value. Once you separate your customers into different value tiers, you can see where your profits are really coming from. Look at your VIPs, specifically the 5% on top: How much of your total revenue is provided by just this 5% of your customer base?

With defined levels of customer value, you can then focus on converting loyal customers from their current tier to a higher one.

Prevent Churn

Now that you now know the average order value and purchase frequency of your customers, it's possible to craft personalized messaging and send the right offer to the right person at the right time.

Find Your Weak Point and Strengthen It

The insights gained from calculating your CLV will show you which of your company's KPIs need improvement — you’ll be able to see which area you most need to invest your time and money into.

Plan Your Yearly Advertising Budget

If you know your CLV, you can determine how much you can spend on customer acquisition while remaining profitable. This, in turn, allows you to accurately determine how much you’ll need to spend on advertising.

Measure Your Ad Performance

Without CLV, you’re inevitably defining a customer's value by the profit from their first purchase. But using that number to tell you which customer is more valuable is short-sighted.

Using that logic, if Jim spent $6 and Billy spent $15, Billy is the kind of customer you care about. But after measuring for CLV, you may find that Jim makes multiple purchases a month, while Billy is never seen again.

With your customer lifetime value model in mind, that scenario tells you everything you need to know about your ad spend. You know that the ads you invested in acquiring Jim can actually create more value than the ones that acquired Billy. Scale that with the data of all your customers, and you get the full picture of which ads are most effective for your business.

What Is the Relationship Between CAC and Customer Lifetime Value?

Understanding customer lifetime value is critical in its own right. But it is also one half of an important relationship for businesses to understand — the correlation between LTV and CAC.

Luckily, this correlation is easy to comprehend. Simply put, if you want to know if your ecommerce business is in good shape, your customer acquisition cost needs to be lower than your customer lifetime value.

What Is Customer Acquisition Cost and Why Does It Matter?

CAC measures how much a company spends to acquire new customers. It defines how much money is needed to convince a customer to buy a business' product or service.

It's easy to see why CAC is a crucial metric. You need to know how much your business can spend to acquire enough customers without spending more than the value those customers will bring to your company.

We've covered CAC before in our in-depth blog, but the metric boils down to a simple ratio:

CAC = All Costs Spent on Acquiring Customers in a Given Period / the # of Customers Acquired in That Same Period

Comparing this metric to your customer lifetime value is one of the most vital relationships a business needs to keep under control — it will tell you whether or not your business can succeed. If your CAC is higher than your customer lifetime value, then your business is in serious trouble.

The bottom line is you always want to reduce your CAC as much as possible, while also increasing your customer lifetime value.

How CLV Can Drive Business KPIs (Interview)

Bloomreach clients like Desigual use customer lifetime value to drive critical KPIs for their business. We sat down with Ricardo Gómez, Global Head of 365 Consumer Marketing at Desigual, to understand how Desigual improves its CLV.

BLOOMREACH: What is more important for Desigual: lowering customer acquisition cost or increasing customer lifetime value?

RICARDO: For us, increasing CLV is what matters the most. Our CAC is quite low compared to the business our customers bring to the brand. The biggest acquisitions we do are done when our customers buy and we invite them to join our members program. This is why we have to ensure we’re driving traffic to the stores and increasing the CLV of our database.

BLOOMREACH: What have you found to be the most challenging part of increasing your customers’ lifetime value?

RICARDO: Our CLV is very closely linked to the overall experience we offer and to the quality of the products we sell. Therefore, we largely increase our CLV by making sure there are no pain points — or if there are, that we address them quickly. We also do not send campaigns for products that have had or could have any quality issues.

Omnichannel campaigns are important too; we run several campaigns to move clients who shop offline only to buy online as well. This has a great impact for us.

Finally, we found a correlation between lowered customer value and lower-quality purchased products, so we stopped communications around those items and began to remove the garments we believed to be below our standards.

Why Don’t More Companies Use Customer Lifetime Value Effectively?

With so many benefits and insights to be gained with customer lifetime value models, it's hard to believe that not every business utilizes the formula to its full potential. Here's some of the biggest roadblocks that companies face when trying to take advantage of CLV.

Many Established Companies Keep Their Data in Different Silos

As companies grow, it’s common for their data to become fractured. Different pieces are kept in separate places, and often accessed by different software, as each department pursues its own goals.

This makes collaboration between departments and proper business analysis difficult, commonly resulting in less trustworthy data. If the same information is stored in two places without an effective timestamp to show which is more current, data silos are likely hindering your company’s efforts.

These data silos are detrimental to calculating CLV. Without up-to-date data in one unified and organized place, you aren’t making use of the wealth of information you’re collecting, and your calculations are doomed to be inaccurate. Siloed data is the biggest issue facing modern businesses looking to scale their marketing, and it’s why only 24% of companies believe they are monitoring CLV effectively.

Read This Next: A Single Customer view: Everything you Need To Know

Customers Now Make Purchases From Multiple Devices

With the same customer making purchases from their computer, phone, and tablet, many companies have difficulty combining all their data streams into one measurable whole. Attempting to extract meaningful insight from these separate streams can be both expensive and inefficient. Companies without a main dashboard synthesizing all their customer data in one place will find themselves increasingly left behind.

Companies Lack In-House Skills and AI Technology

Many companies who have not yet begun tracking CLV are dealing with a lack of qualified personnel to follow the data and produce actionable plans based on it. This, coupled with the need for an in-house dashboard for that qualified personnel to use, creates a strong barrier to entry.

Luckily, the rapid evolution of marketing AI tools can help businesses organize and manage all their data without overwhelming marketing teams with tedious tasks.

Calculate and Maximize Your CLV With Bloomreach Engagement

Today’s marketers, data scientists, executives, and business professionals now have a powerful tool to help them determine and utilize customer lifetime value: a customer data platform. A CDP serves as a central hub for all your customer data, collecting it into individual profiles for each customer.

CDP capabilities are essential for calculating CLV, which is why Bloomreach Engagement offers all the key components you need to calculate customer lifetime value, apply it to your marketing efforts, and so much more.

Bloomreach Engagement is an all-in-one platform that helps marketers create personalized campaigns for every customer. Our solution combines the power of a customer data platform with the speed and scale of AI, helping you reach customers where and when it matters most.

It’s designed to impact every phase of your customer journey, providing a single marketing view of real-time customer data, campaign automation across 13 channels, and analytics that make it easy to grow your brand and your revenue — fast.

Learn more about the importance of understanding customer lifetime value by checking our CAC/LTV calculator. If you're looking to reduce your customer acquisition costs while simultaneously increasing your customer lifetime value, our calculator will give you a precise calculation to begin your pursuits.

Found this useful? Subscribe to our newsletter or share it.